Almost overnight, the world went online. Global distancing measures and quarantines as a response to Covid-19 have resulted in unprecedented digitisation in every facet of our lives.

In both dealing with the immediate reality of the situation, and the long-lasting changes we will see as a by-product, it’s prudent for brands and media owners to consider how relationships (with consumers and with each other) are likely to change, and what actions they need to take because of these changes.

What does it mean for consumers?

The youthful and naturally technophile digital community may be interested to learn that, prior to recent events, online shopping was not quite as prevalent as their personal experiences may suggest.

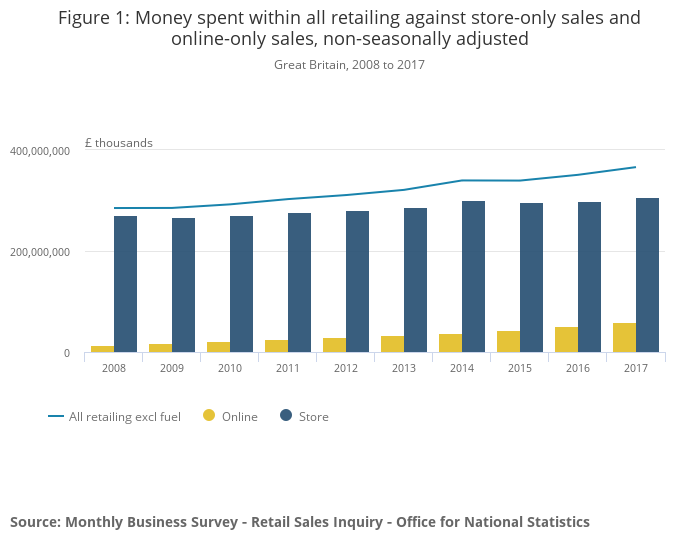

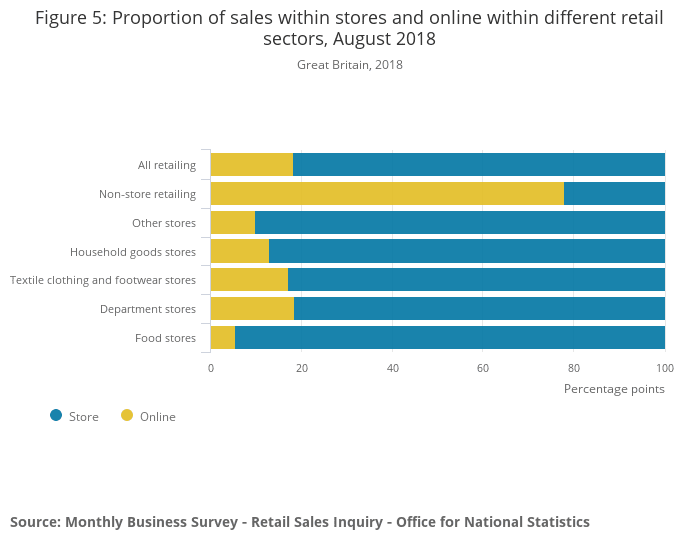

Indeed ONS retail sales data for 2018 shows that online sales accounted for just over 18% of total transaction value. While it’s true that number has grown rapidly in the preceding years, the baseline is still perhaps significantly lower than many would expect. Furthermore, the distribution across sectors is also marked (only 6% transacted online in food stores for example).

In recent weeks, however, this has changed: self-isolation, social-distancing and common-sense has prompted many new consumers to test the digital water.

It feels a reasonable assumption that at least some of these new converts will continue to use these new channels. The most obvious group affected by this would be older consumers who may have been late to adopt digitisation, but due to current circumstances have been forced to learn the digital ropes. This is particularly important as it could help to level the digital playing field and make that group of society feel less excluded from an increasingly online world.

The other side of this coin of course is that retailers are seeing unprecedented demand for their digital services.

The suddenly-digital retailer

Not only are retailers seeing this huge inbound demand for their digital store fronts, but for those selling non-essential products, those virtual shops are now their only route to revenue. We have heard first-hand from many of our retail customers that they are accelerating to execute against digital-first strategies in a matter of weeks. They are making short term pivots to pure-play online businesses.

The question for these retailers (and indeed consumers) then becomes, “to what degree do temporary measures taken in-extremis become adopted longer term?” Perhaps now is an opportunity to make systematic optimisations to customer experience through digital technologies.

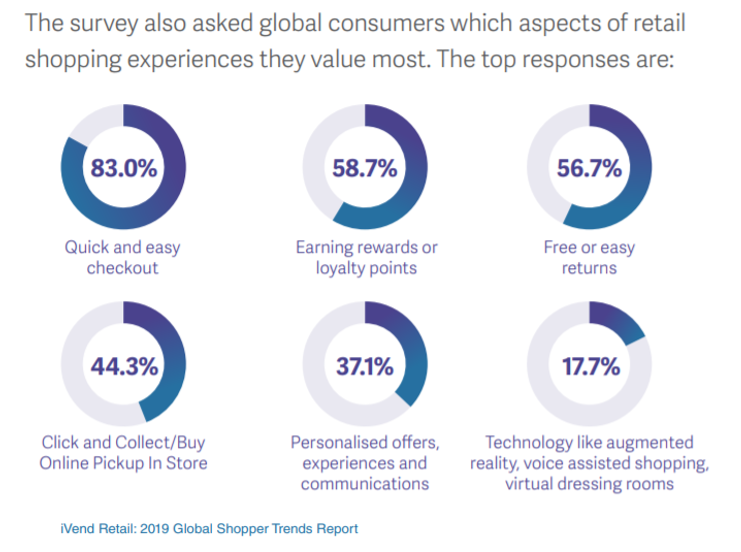

A simple example would be a retailer addressing an immediate need and implementing solutions to better identify an offline customer when they appear online and then finding that capability is useful post pandemic. Once stores are open again as normal it is likely that retailers will be left with a more joined up offline-online customer experience, for example better provision of “click and collect” as an interface between virtual and real. According to research from iVend this is a good thing:

What about Marketers and Media Owners?

In times of uncertainty a rational response for B2C businesses is to postpone discretionary expenditure, which for many means across-the-board marketing disinvestment. Ironically this is a stark counterpoint to digitally focussed media owners who are seeing a surge in traffic to their online properties, as more and more of us seek information and entertainment from outside our literal four-walls.

Compounding this there is an underlying change in consumer behaviour, which means:

- Appetite, indeed an urgent need in some cases, to trial and sample new products. This ranges from parents across the country needing to become experts in educational board games, health-minded individuals looking for at-home exercise equipment and nutritional supplements through to supermarket shoppers forced to opt for premium brands of toilet tissue.

- For some, at least a substitution of disposable income from temporarily suspended activities like eating out and commuting.

In this fluid environment it could be argued that marketers should actively reinforce the availability and benefits of their products with a more engaged and motivated public. Of course this must be done sympathetically and not in an opportunistic manner..

Finally, marketers should consider if some of the changes above will in fact persist after “pandemic crisis point” and what this means for their ongoing digital strategies. Media owners should ask themselves how they can provide tools to make it more compelling for marketers to move investment from out-of-home and in-store channels into digital.

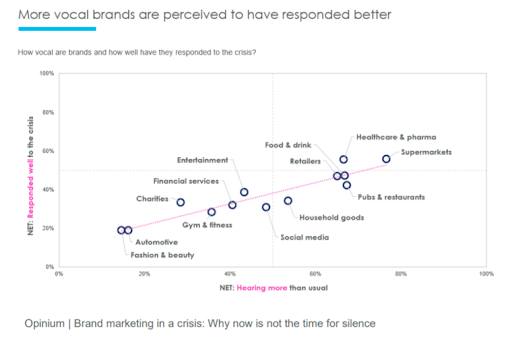

And both marketers and media owners should take note of the conclusion from Kantar market research that “only 6% of UK and US respondents [are] saying that they don’t think it’s appropriate for brands to be advertising at the moment”, as well as research from Opinium who asked consumers “Would you like to hear more or less from these types of company?” (results below):

So what?

The message is simple and optimistic: Following the unparallelled disruption of the Covid-19 pandemic, perhaps there is the opportunity for retailers, brands and media owners to provide better and more inclusive experiences to a broader and more engaged range of end consumers.

LiveRamp stands ready to provide the tools and technologies to help make those connections with end-consumers while, of course, respecting their privacy and preferences.